Glossary 11 – Dilution

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...

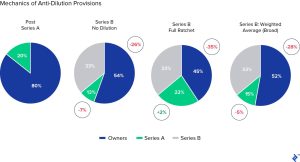

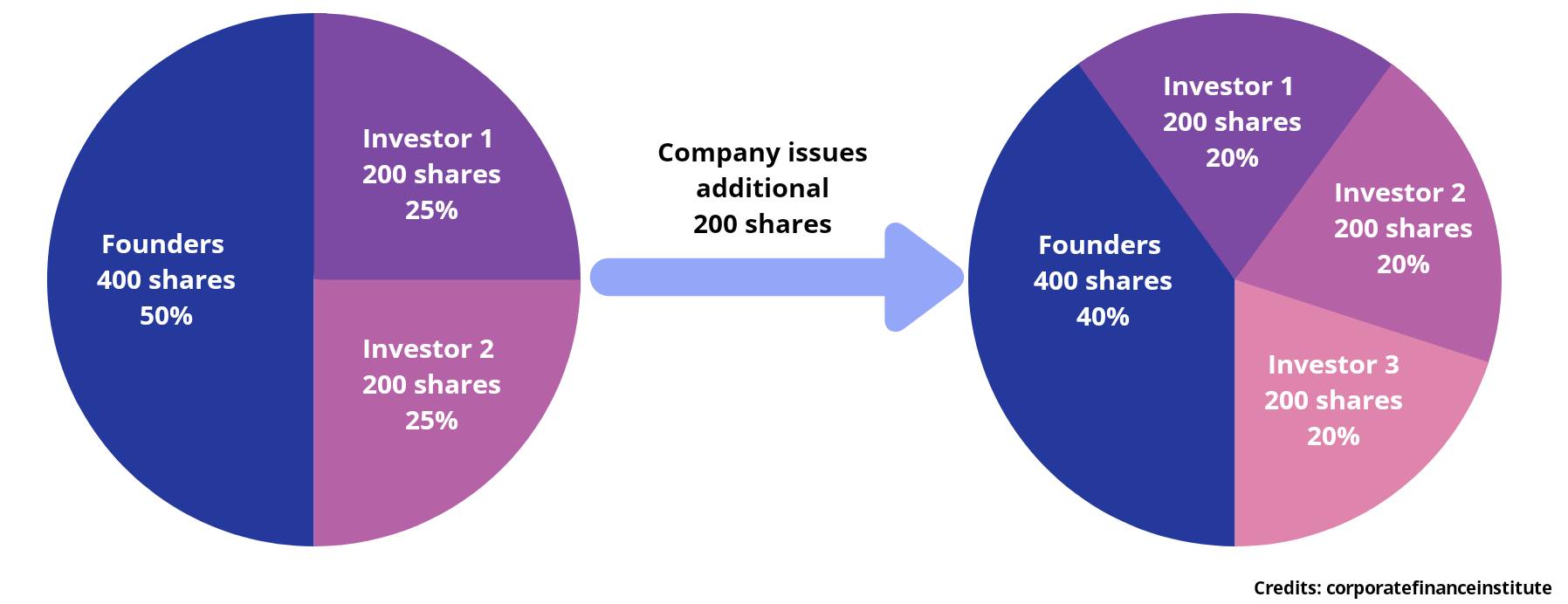

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares...

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

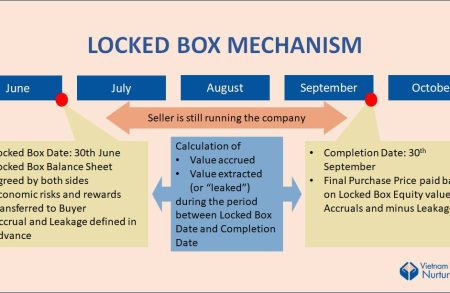

Locked Box is one of the two most common mechanisms employed in mergers and acquisitions (M&A) transactions to facilitate the...

Private Equity is considered a financial booster shot for growth companies, and sometimes a financial superhero saving distressed firms. It's...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

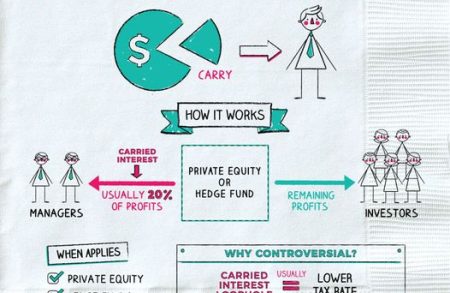

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can...

Due diligence (DD) in M&A and Private Equity (PE) is a comprehensive investigation process conducted by buyers or investors to...

The capital structure of a company plays a crucial role in its financial stability and overall business performance. Private equity,...