Glossary 10 – Exit Strategy

Besides knowledge and skills in domain of finance, dealmakers are required to have good understanding about the key legal documents...

A liquidity event is a pivotal moment in the private equity world, signifying the successful "exit" from an investment in...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

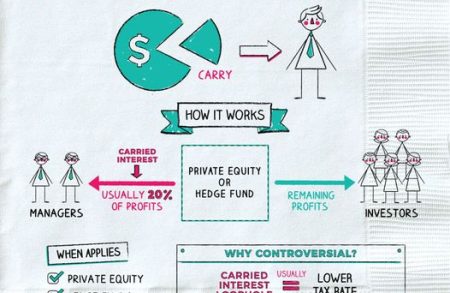

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can...

The capital structure of a company plays a crucial role in its financial stability and overall business performance. Private equity,...

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

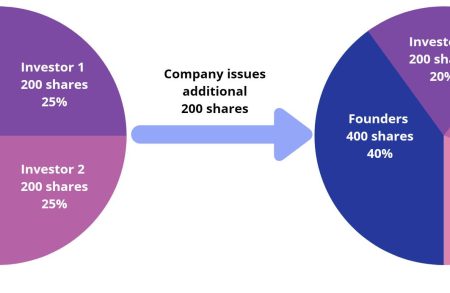

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares...

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...