09Nov

In private equity investment, the concepts of pre-money and post-money valuations play a pivotal role in assessing the value of a company (or market capitalisation) before and after an investment round. The pre-money valuation represents the estimated worth of the company just before new capital infusion, while the post-money valuation includes the pre-money valuation plus the investment amount. These valuation parameters are critical for both investors and entrepreneurs as they determine ownership stakes and the dilution effect.

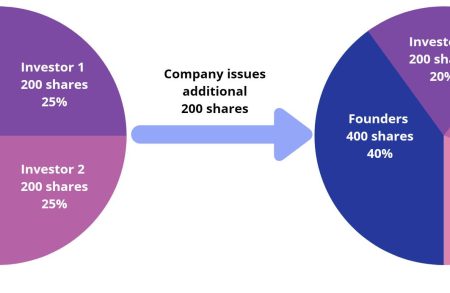

Calculating these valuations involves several methods and parameters. Pre-money valuation relies on various factors such as the company’s historical financial performance, market potential, industry comparables, and the negotiation between investors and entrepreneurs. Post-money valuation is calculated by adding the invested capital to the pre-money valuation. The ownership percentage can be determined by dividing the investment amount by the post-money valuation. Dilution impact on existing shareholders can also be assessed using these valuation parameters. Understanding the pre-money and post-money valuations is essential for making informed investment decisions and structuring deals that align the interests of all parties involved in private equity transactions.

For example, a Private Equity (PE) Fund proposes to invest USD10 million into the company of Mr. Nam in exchange for a shareholding of 20%. This proposal means that the PE Fund suggests a Post-Money valuation of USD50 million (USD10 million divided by 20%) for the company. As a result, the Pre-Money valuation of Mr. Nam’s company is USD40 million (USD50 million – USD10 million).