Private Equity (PE) and Venture Capital (VC) are two pillars of alternative investments. While they share some similarities, their approaches, risk profiles, and strategies differ significantly, making them suitable for different types of investors and businesses.

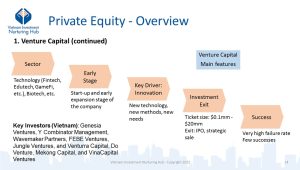

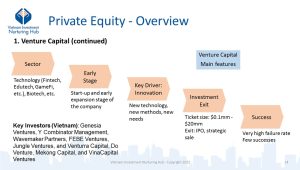

Sector and Industry

Private equity funds typically invest in companies in traditional sectors, while venture capitalists are commonly associated with tech and other innovative industries. Any sector ensuring that demonstrates scalability can be a target sector of PE funds. In the meantime, VC funds mostly focus on sectors which involve disruptive innovation and generate new approach in consumption and production.

Investment Stage and Focus

PE firms typically target mature companies, with established revenues and cash flows. Their goal is to restructure, streamline, or expand these companies, adding value before a profitable exit. In contrast, VC focuses on early-stage startups with high growth potential but unproven business models. VC investors often seek disruptive technologies or innovative business ideas.

Ownership and control

PE firms usually acquire a controlling stake or significant ownership in investee companies, enabling them to directly implement strategic and operational changes. VC investors, however, prefer minority stakes, often providing guidance, resources, and industry connections rather than direct control.

Investment Strategy

Returns in PE hinge on enhancing the value of existing companies through strategic improvement and exit strategies. VC returns rely on the exponential growth of a few investee companies, aiming for lucrative exits via IPOs or acquisitions.

Investment Horizon and Exit Strategies

PE investments usually have a medium-term horizon (5-8 years), focusing on exits through mergers and acquisitions or public listings. VC investments have longer timeframe (7 – 10 years) and rely on acquisitions by larger firms or Initial Public Offerings (IPOs) as exit strategies.

Risk and Return

Compared to VC, PE offers a more stable and predictable path to returns, with very low risk of significant losses. Besides, PE investments have historically delivered solid returns. Over the past 2 decades, the global PE index has achieved an annualized return of 10.5%, compared to 7.0% from a global public equity portfolio. (Source: plantemoran.com).

In contrast, failure rate for startups is high. Research indicates that up to 75% of venture-backed startups do not return cash to investors, with 30% to 40% of these companies liquidating assets, resulting in total loss for investors (Source: hbs.edu). However, a few successful investments can can yield exponential returns. Top-performing VC funds have an average annual return ranging from 15% to 27% over the past 10 years, compared to an average annual return of 9.9% S&P 500 in the same period (Source: seraf-investor.com).

In essence, PE is about optimizing existing businesses, while VC is about nurturing future giants. Understanding these distinctions helps investors align their capital with their risk tolerance and investment goals.