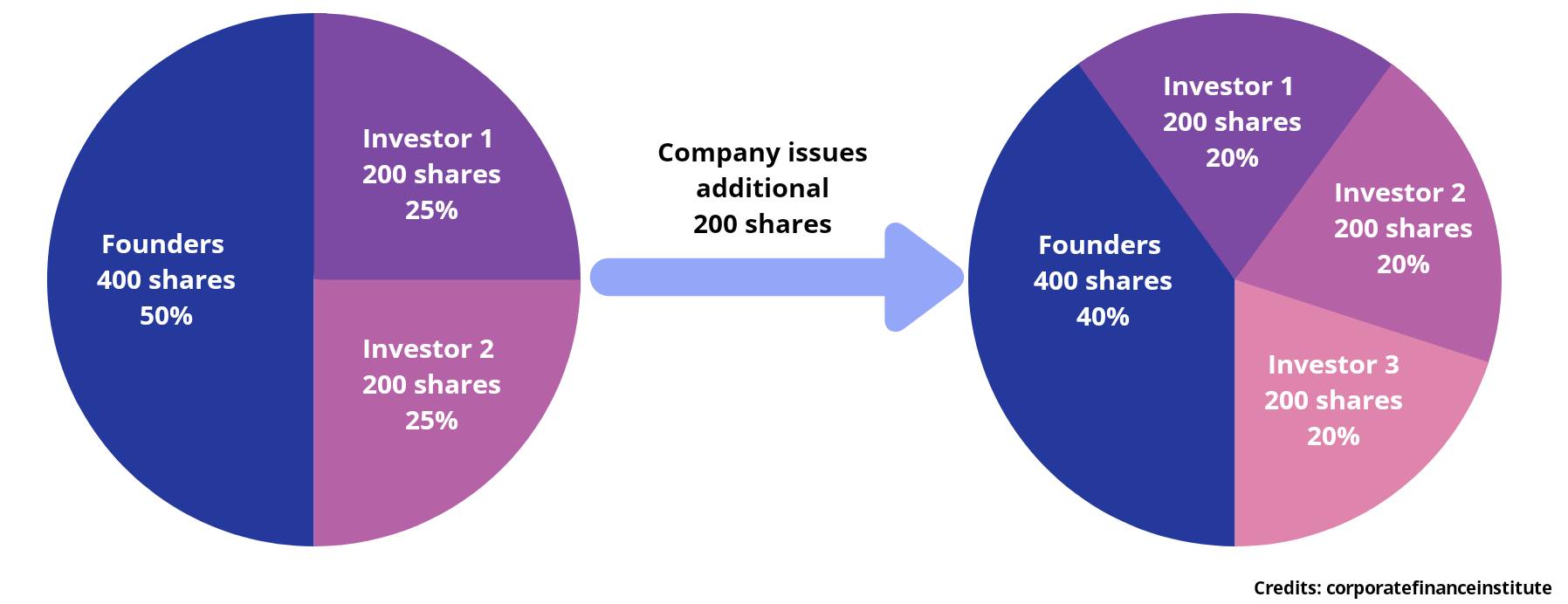

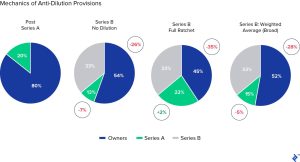

Glossary 11 – Dilution

In the dynamic world of private equity (PE), deal-makers are constantly seeking innovative ways to unlock value. One strategy gaining...

A liquidity event is a pivotal moment in the private equity world, signifying the successful "exit" from an investment in...

The banking industry plays a crucial role in the global economy, but not all banking services are the same way....

Multiple on Invested Capital (“MOIC”) is a metric used to describe the value or performance of an investment relative to...

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

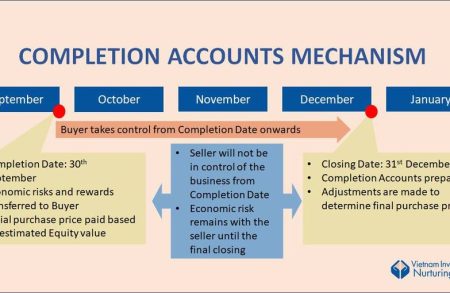

Besides Locked Box mechanism, Completion Account is another common way employed in mergers and acquisitions (M&A) transactions. The Completion Accounts...

Due diligence (DD) in M&A and Private Equity (PE) is a comprehensive investigation process conducted by buyers or investors to...