29/08/2024

We already heard about DCF valuation method. How about DFCF?

In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

01/03/2024

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

05/07/2024

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

19/03/2024

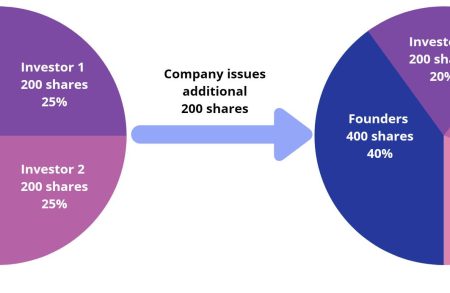

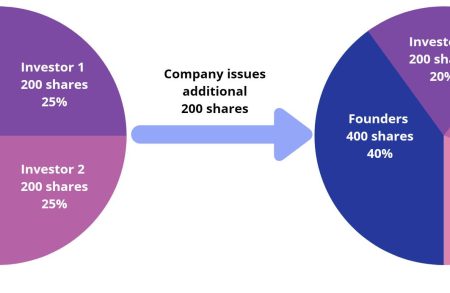

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...

10/02/2025

The banking industry plays a crucial role in the global economy, but not all banking services are the same way....

13/09/2024

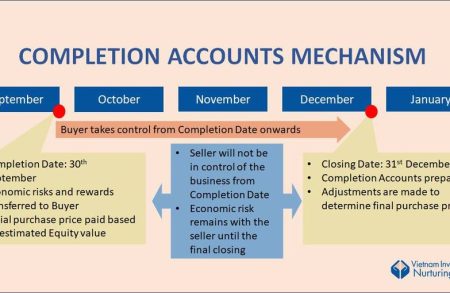

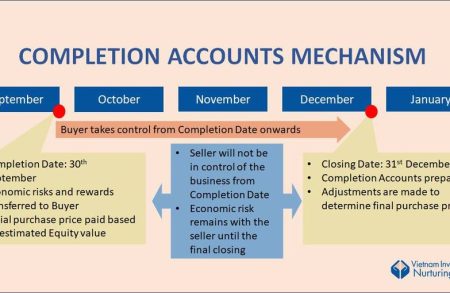

Besides Locked Box mechanism, Completion Account is another common way employed in mergers and acquisitions (M&A) transactions. The Completion Accounts...

09/11/2023

In private equity investment, the concepts of pre-money and post-money valuations play a pivotal role in assessing the value of...

24/08/2024

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

15/11/2023

The capital structure of a company plays a crucial role in its financial stability and overall business performance. Private equity,...

20/10/2023

Private Equity is considered a financial booster shot for growth companies, and sometimes a financial superhero saving distressed firms. It's...