Glossary 5: Capital Structure and Private Equity Capital

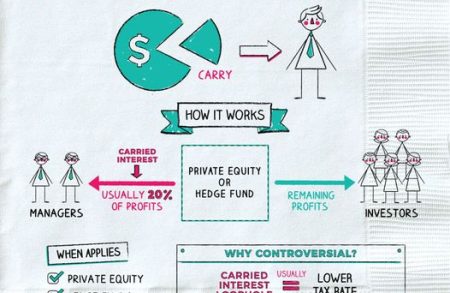

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can...

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

Recapitalization, a financial strategy often employed in the dynamic landscape of private equity and investment banking, plays a pivotal role...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...

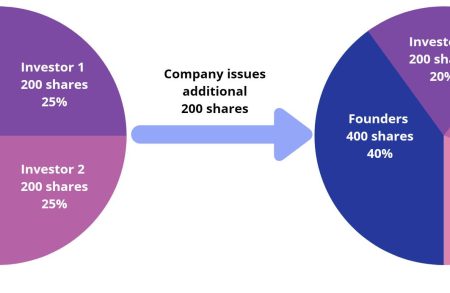

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...

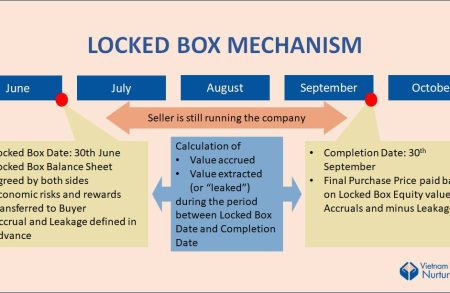

Locked Box is one of the two most common mechanisms employed in mergers and acquisitions (M&A) transactions to facilitate the...

Besides knowledge and skills in domain of finance, dealmakers are required to have good understanding about the key legal documents...

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...