Glossary 10 – Exit Strategy

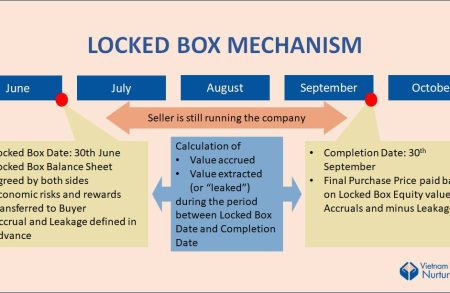

Locked Box is one of the two most common mechanisms employed in mergers and acquisitions (M&A) transactions to facilitate the...

The banking industry plays a crucial role in the global economy, but not all banking services are the same way....

Private Equity (PE) firms employ various strategies to acquire, invest in, or provide financing to private companies with the goal...

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

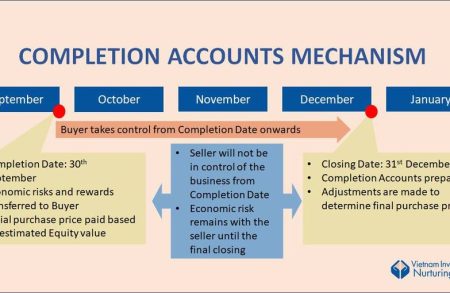

Besides Locked Box mechanism, Completion Account is another common way employed in mergers and acquisitions (M&A) transactions. The Completion Accounts...

Besides knowledge and skills in domain of finance, dealmakers are required to have good understanding about the key legal documents...

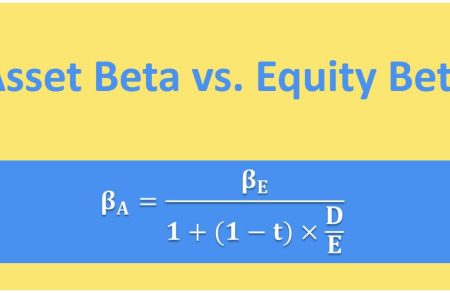

Beta is a financial metric that measures the sensitivity of an asset's returns in relation to the overall market movements,...

In private equity investment, the concepts of pre-money and post-money valuations play a pivotal role in assessing the value of...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...