Glossary 8 – Mezzanine Debt

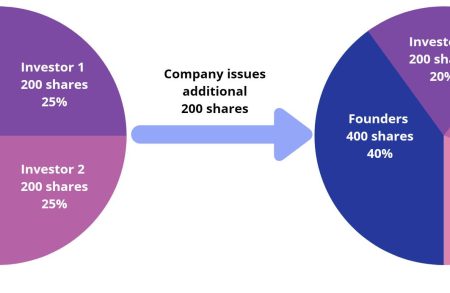

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...

The banking industry plays a crucial role in the global economy, but not all banking services are the same way....

In private equity investment, the concepts of pre-money and post-money valuations play a pivotal role in assessing the value of...

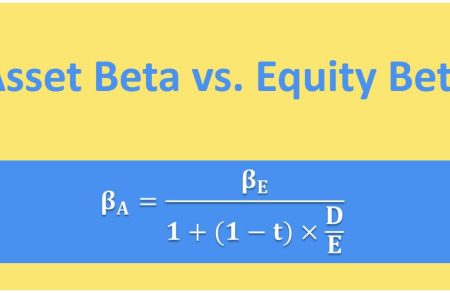

Beta is a financial metric that measures the sensitivity of an asset's returns in relation to the overall market movements,...

Multiple on Invested Capital (“MOIC”) is a metric used to describe the value or performance of an investment relative to...

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

Recapitalization, a financial strategy often employed in the dynamic landscape of private equity and investment banking, plays a pivotal role...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

A liquidity event is a pivotal moment in the private equity world, signifying the successful "exit" from an investment in...