Glossary 10 – Exit Strategy

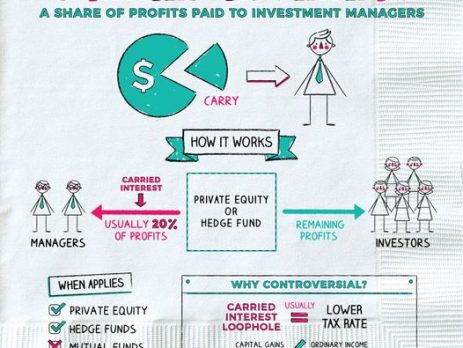

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding investment decisions and ensuring the investment’s alignment with the ultimate goals of the fund. Private equity investors typically employ various exit...