Recently, Private Equity has been included in one of the 3 specialised pathways of the Level 3 curriculum of CFA Program. Why a career in Private Equity is highly desirable by finance professionals, not only in Vietnam but also in other countries? This is because this type of job offers a blend of challenges, significant financial rewards, and a chance to do some thing meaningful for the growth and development of the investee companies. Success in private equity (PE) requires an analytical mindset, strong networking capabilities, and a deep understanding of the unique operations that drive PE firms.

What Does a Career in Private Equity Involve?

A career in private equity offers a fast-paced, competitive work environment where professionals analyze investment opportunities, oversee company transformations, and guide companies towards more profitable operations. Intitially, PE funds use funds raised from investors to invest in private companies or buy out public companies. By acquiring a significant or controlling stake in a company, PE funds gain influence over management, business operations, and strategies to increase value for shareholders. This career path demands a high level of skill and dedication but offers substantial rewards, both in terms of compensation and professional growth.

The Nature of Private Equity Funds

Private equity firms vary in size, ranging from a small team of 5-10 professionals to large global PE firms. Despite their size differences, PE firms share similar investment objectives and methods. They utilize funds from external capital to buy equity in various portfolio companies. The investments span across multiple industries and business stages, with PE funds often targeting struggling or undervalued companies that show potential for significant returns. PE funds typically hold onto their investments for around 5 years, before exiting for a profit. Strategies of PE funds include venture capital (funding early-stage startups), growth equity (investing in companies with proven success but needing additional capital to expand), and buyouts (targeting struggling or undervalued companies where significant operational changes can drive value).

The Career Ladder in Private Equity

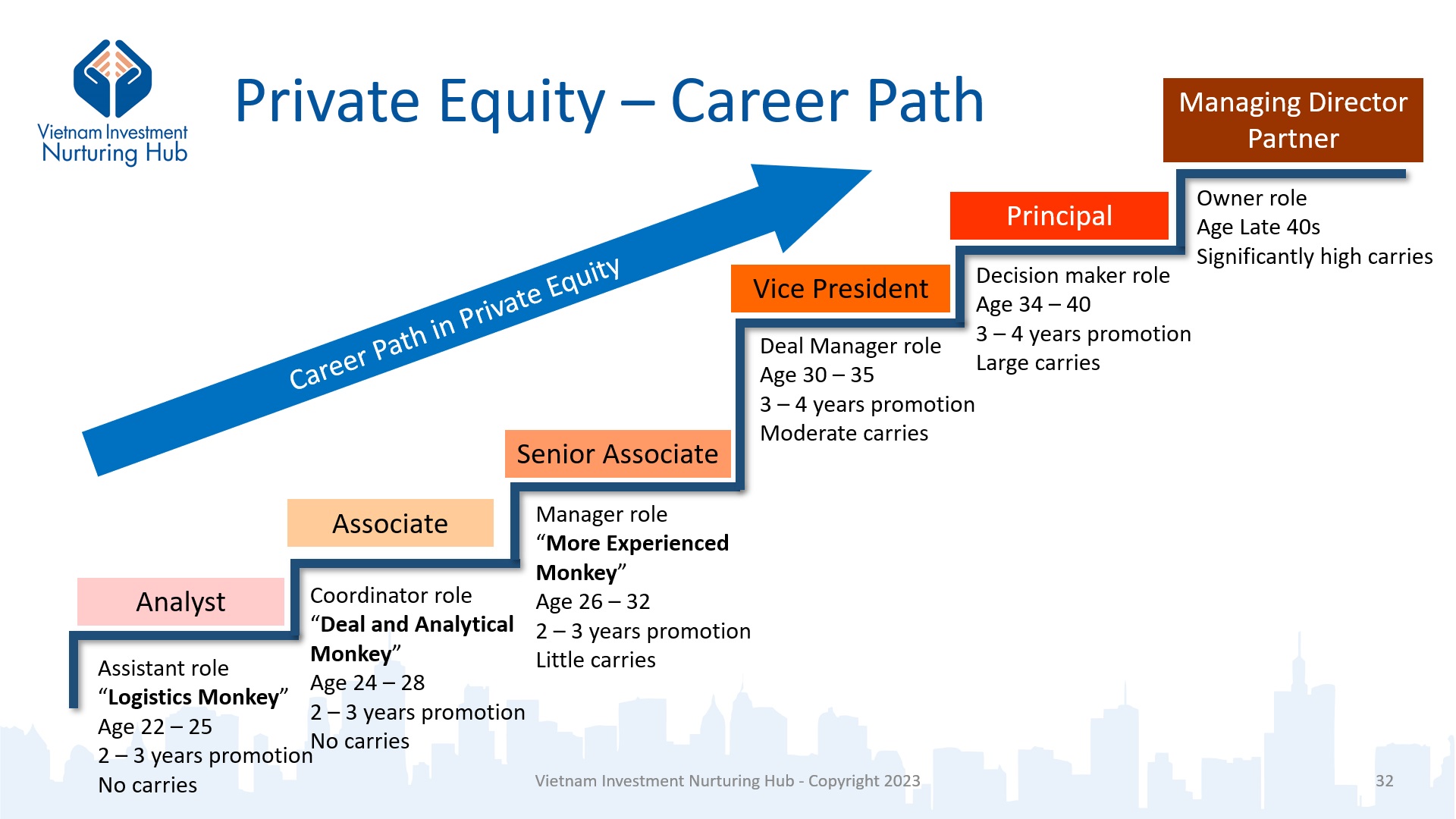

The career progression within a PE firm is structured and involves several levels, each with distinct responsibilities.

– Analyst: this entry-level position handles assistant tasks, such as reviewing financial data and conducting preliminary analyses. Key skills include financial modeling and the ability to analyze companies.

– Associate: this mid-level position has more autonomy and play more active role in the investment process, such as guiding and coordinating with companies in the portfolio.

– Vice President (VP): this management position focuses on relationship and communication, such as client interactions, building relationships, and handling high-level negotiations and training staff. Strong negotiation skills are paramount as VPs often work directly with clients and other stakeholders in decision-making processes.

– Director: Directors make key decision, conduct fundraising tasks, and handle high-level negotiations. They lead major deals and make crucial decisions regarding acquisitions and divestitures.

– Partner: As the highest position in a PE firm, partners represent the firm in dealings with clients and investors of their funds, secure funding and drive the overall direction of the firm. Partners typically invest their capital into the PE firm, aligning their interests with those of investors.

Is Private Equity the Right Career Path?

A career in private equity demands strong qualifications, significant prior experience, and the ability to perform in a high-pressure environment. PE professionals work long hours, often under intense scrutiny, and must possess a strong passion for financial markets and strategic deal-making.

Educational and Professional Qualifications:

PE professionals are generally expected to hold bright academic records from finance, accounting, or economics backgrounds. Prior experience in investment banking or a related field is highly recommended due to the competitive nature of the industry. Internships or relevant work experience help candidates gain insight into PE operations and build their professional networks.

Core Skills and Abilities

Success in private equity requires a blend of analytical, problem-solving, and communication skills. Professionals must be adept at analyzing financial statements, conducting market research, and formulating financial models for valuation. Ability to implement acquisition analysis, market research, and preparing confidential information memorandums (CIMs) is also valuable. Networking is equally important, as PE firms value connections and relationships that can help generate new investment opportunities and build trust with LPs.

Conclusion

Private equity is a rewarding but highly demanding career path, suitable for those with a strong aptitude for finance, problem-solving, and the resilience to manage intense workloads. The career progression, from junior associate to partner, offers increasing levels of responsibility, significant financial rewards, and opportunities for professional growth. Although it is competitive, a career in private equity is achievable for those who dedicate themselves to developing the necessary skills, gaining relevant experience, and building a robust professional network.

Next: Who succeeded with private equity and investment banking background?