09Sep

Locked Box is one of the two most common mechanisms employed in mergers and acquisitions (M&A) transactions to facilitate the transfer of purchase price (the amount to be paid to the vendor) and ensure that the target company’s assets and liabilities are accurately accounted for.

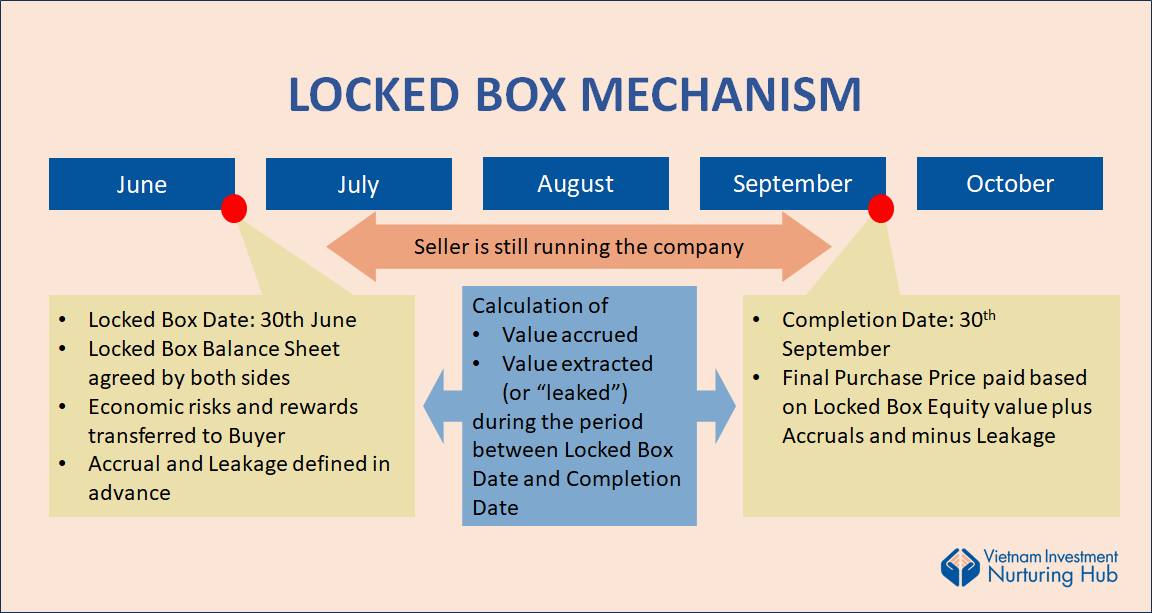

The Locked Box mechanism sets the purchase price based on the target company’s balance sheet at a pre-determined date (a “Locked Box Date”, before completion date). The seller and buyer agree that the financials are “locked” from Locked Box Date onward, meaning no adjustments are made for any post-Locked Box Date financial performance and any changes in the target company’s assets and liabilities after the Locked Box Date are not reflected in the purchase price, except those pre-defined and pre-agreed as Accruals and Leakages. The Locked Box mechanism involves creating a segregated account, typically held by an independent escrow agent (a bank), into which the buyer deposits the purchase price. This provides certainty for both buyer and seller regarding the purchase price and prevents disputes arising from post-closing adjustments.

Under the Locked Box mechanism, the economic risks and rewards are transferred to the buyer from the Locked Box Date and the buyer assumes the risk of any potential deterioration in the company’s financial condition after such date (although this risk can be mitigated by warranties and covenants). As the seller continues to run the business between the Locked Box Date and Completion Date, further purchase price adjustments are expected to be made in respect of a value accrual (called “Accruals”, for example, new profit generated, salary of seller, interest income on payable purchase price) and agreed leakage (called “Leakage”, such as dividend paid, transaction related costs, success fee paid to investment banker, bonus to management team, etc.).

In simple transactions with minimal expected adjustments, Locked Box mechanism is often selected, as it provides greater a faster closing process, certainty for both parties and reduces the risk of post-closing disputes. However, this mechanism can be not flexible enough and may not accommodate unforeseen changes in complex transactions.