17/12/2023

In the dynamic landscape of the private equity industry, a critical phase that marks the culmination of an investment cycle...

27/10/2023

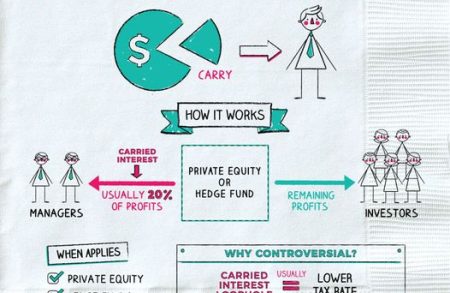

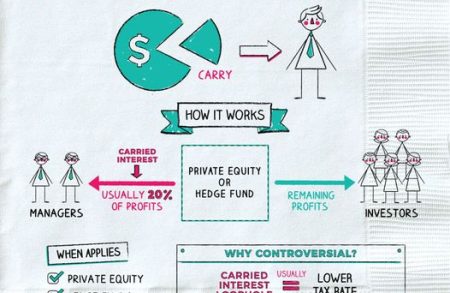

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can...

13/01/2024

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

19/03/2024

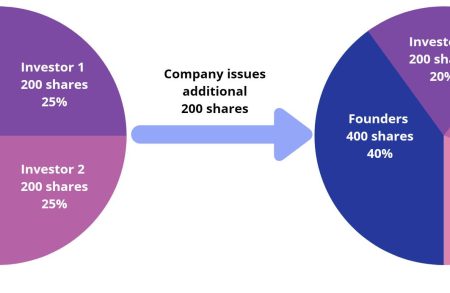

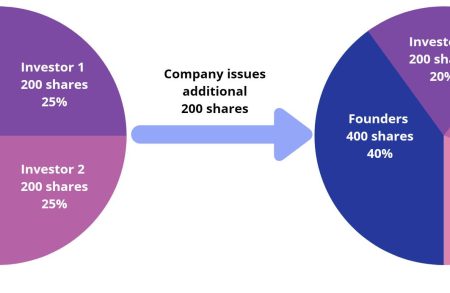

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...

03/08/2024

Besides knowledge and skills in domain of finance, dealmakers are required to have good understanding about the key legal documents...

11/05/2024

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares...

24/08/2024

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

05/07/2024

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

01/11/2023

Multiple on Invested Capital (“MOIC”) is a metric used to describe the value or performance of an investment relative to...

01/03/2024

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...