Glossary 6: Beta and the use of beta in Private Equity

Mezzanine debt, a hybrid financing instrument between traditional debt and equity, is a pivotal component in private equity transactions. Positioned...

In the world of private equity (PE) and investment banking (IB), beyond deal origination, due diligence and negotiation, lies another...

In private equity investment, the concepts of pre-money and post-money valuations play a pivotal role in assessing the value of...

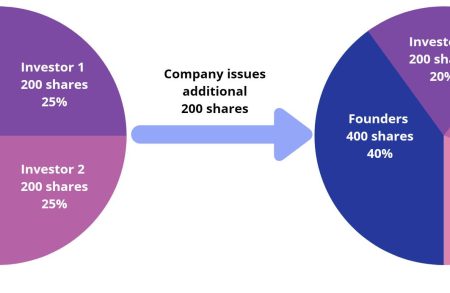

In private equity investments (PE), dilution is a critical concern that investors must address when negotiating investment terms. Dilution occurs...

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

In the dynamic world of private equity (PE), deal-makers are constantly seeking innovative ways to unlock value. One strategy gaining...

A liquidity event is a pivotal moment in the private equity world, signifying the successful "exit" from an investment in...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

Multiple on Invested Capital (“MOIC”) is a metric used to describe the value or performance of an investment relative to...