Glossary 5: Capital Structure and Private Equity Capital

In the dynamic world of private equity (PE), deal-makers are constantly seeking innovative ways to unlock value. One strategy gaining...

Due diligence (DD) in M&A and Private Equity (PE) is a comprehensive investigation process conducted by buyers or investors to...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...

Crafting an effective exit strategy is paramount in private equity investment as it provides direction right from the outset, guiding...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares...

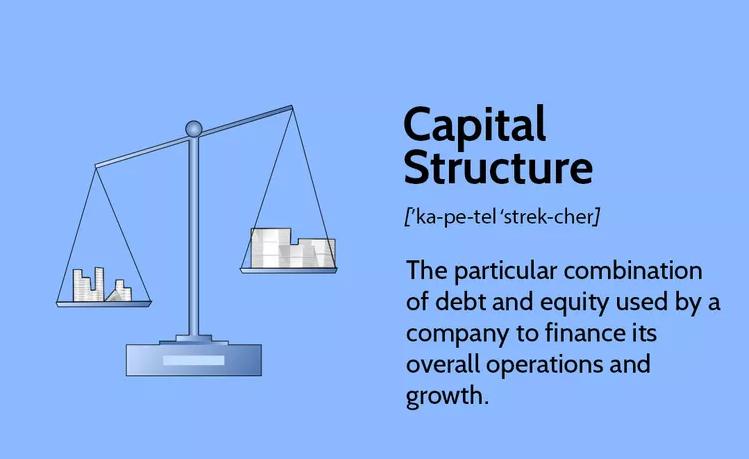

In advanced capital markets, private companies often seek private equity (PE) investors as shareholders primarily to access expansion and growth...

Recapitalization, a financial strategy often employed in the dynamic landscape of private equity and investment banking, plays a pivotal role...

Private Equity (PE) firms employ various strategies to acquire, invest in, or provide financing to private companies with the goal...

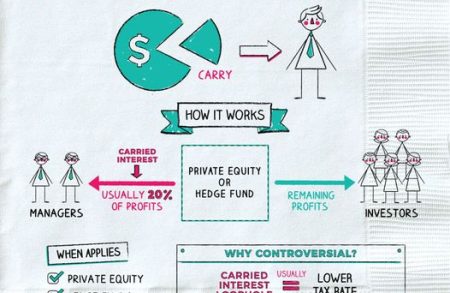

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can...