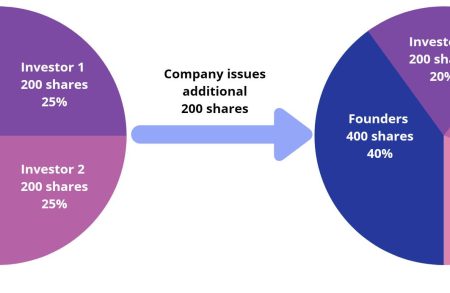

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares at lower valuations than the previous fund-raising rounds, decreasing the existing investors’ ownership percentage. At its core, the anti-dilution clause aims to maintain the proportional ownership of existing investors by adjusting the number of shares they hold or the price they paid per share if subsequent rounds of funding occur at a lower valuation. This provision ensures that early investors are not unfairly penalized for supporting a company during its infancy, where valuation fluctuations are common. In practice, there are two primary categories of anti-dilution clauses, each offering a different level of protection to investors:

- Full Ratchet Anti-Dilution: this offers the strongest protection and thus is more investor-friendly, but unfavourable to existing shareholders. If the company issues new shares at a lower price than any previous round, full ratchet provision adjusts the conversion price of all outstanding investor’s preferred shares (which can be converted into common shares) to the price of the new issuance. This ensures investors’ ownership percentage remains proportional to their initial investment. While keeping the ownership proportion of the investors’ unchanged, full rachet clause may significantly reduce the ownership of founding shareholders in the company, even to zero. This was probably what happened to the founders of the Kafe coffee shop chain in Vietnam few years ago.

- Weighted Average Anti-Dilution: This clause considers both the price and the number of shares issued in the new round, offering a more balanced approach for existing shareholders and a more moderate level of protection for investors. With Weighted Average Anti-Dilution clause, the conversion price adjusts based on the average price per share across all funding rounds, including the lower-priced round. While this clause doesn’t fully shield investors from dilution, it offers a fairer adjustment compared to the initial investment price.

The choice of which anti-dilution clause to use depends on the specific investment and the risk tolerance of the investor. Full ratchet offers maximum protection but can discourage future funding rounds by making it harder for the company to offer lower share prices. Weighted average strikes a balance, offering some protection while allowing the company some flexibility in future financing. In short, the anti-dilution clause is a crucial tool in private equity, ensuring a fairer playing field for investors and mitigating the risks associated with ownership dilution in a dynamic investment landscape.