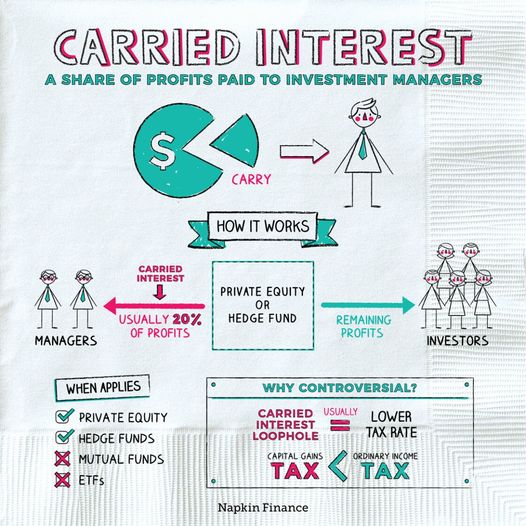

Glossary 2: Carried Interest

Private Equity (PE) managers always seek for carried interest, which is sometimes far more significant than regular remuneration and can make up the main part of the Private Equity Managers’ wealth.

Carried interest is a fundamental component of compensation in PE sector, incentivizing PE fund managers to achieve superior returns for their investors. This mechanism allows these professionals to receive part of the profits generated from successful investments.

Calculating carried interest involves several key methods and parameters. Typically, carried interest is determined as a percentage of the fund’s profits, often around 20%, after meeting certain performance benchmarks. Key parameters in this calculation include the preferred return rate, also known as the hurdle rate, which represents the minimum return investors expect before the carry is earned. The timing of carried interest distribution is another crucial factor, with some funds distributing it annually, while others do so upon exit events. Furthermore, clawbacks provisions are adopted to ensure the fair distribution of carry over time. These provisions may require fund managers to return previously distributed carry in case of underperformance.

By applying proper mechanism, PE fund managers ensure that carried interest aligns the interests of both investors and fund managers, fostering a commitment to generating robust returns and enhancing wealth.