Glossary 9 – Recapitalisation

Due diligence (DD) in M&A and Private Equity (PE) is a comprehensive investigation process conducted by buyers or investors to...

In private equity (PE) investment, exit rights provide PE investors with strategies to sell their shares when it is not...

In the world of private equity, investors face a constant threat: dilution. This occurs when a company issues new shares...

In the dynamic landscape of the private equity industry, a critical phase that marks the culmination of an investment cycle...

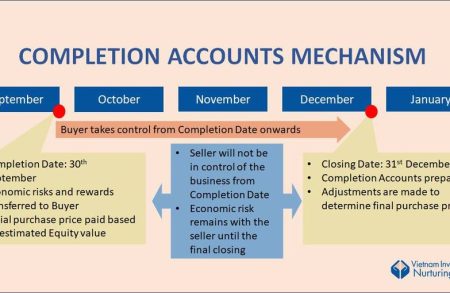

Besides Locked Box mechanism, Completion Account is another common way employed in mergers and acquisitions (M&A) transactions. The Completion Accounts...

We already heard about DCF valuation method. How about DFCF? In mergers and acquisitions (M&A), the Debt-Free Cash-Free (DFCF) approach is...

Private equity (PE) investors are constantly asking: what's this company really worth? It's a crucial question, as it dictates deal...

The banking industry plays a crucial role in the global economy, but not all banking services are the same way....

In the world of private equity (PE) and investment banking (IB), beyond deal origination, due diligence and negotiation, lies another...

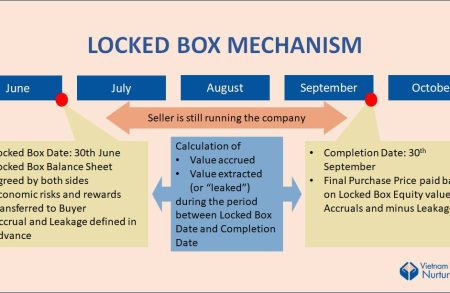

Locked Box is one of the two most common mechanisms employed in mergers and acquisitions (M&A) transactions to facilitate the...